We Work are one of the best-known providers of office space in the world. They have office space available in the US, all the way through Europe, to the middle East and Asia. Yet in November of 2024 it filed for Chapter 11 bankruptcy in the US. They cited rising interest rates and a falling demand in office space (due to home working) as the main causes.

However, the current market does not reflect that. Whilst flexible/hybrid working has increased, there is a shift in people going or trying to go back into the office. We are also seeing more freelancers, startups, and small consultancies than ever before. They should be seen as key targets for WeWork’s original model.

Neumann, the founder and former owner of the company, is also desperately trying to buy or refinance the company, highlighting that there may well be more opportunity for a brand like WeWork to thrive moving forward.

Rise – Why WeWork?

Founded in 2010 in Manhattan, we work quickly grew to be one of the fastest growing companies in the world with a valuation of $47 billion in 2019. WeWork’s strengths came down to how it set itself apart from the wider market:

Flipping the traditional office model

Rather than focusing on larger, longer term office leasing, WeWork pushed more flexible coworking spaces. This catered particularly well to small businesses and start ups who needed the space, but lacked the funds of major offices.

Community and Culture

Alongside developing a proposition for these startups and freelancers, they also focused on building a community within the spaces. The idea was that it created office space that allowed smaller businesses to grow, collaborate and network.

Design and Freebies

The office spaces were not just being functional, but cool. They often were equipped with high end furnishings and freebies like good quality coffee, and even beer on tap.

Branding and Marketing

All of these features helped to place WeWork as one of the best places for up-and-coming businesses. They leant into this image and kept pushing on it, aiming to become one a hub for innovation and entrepreneurship. This in turn attracted larger businesses who were keen to benefit from WeWork’s strengths.

Investment and Aggressive Expansion

WeWork were aggressive early on, attracting significant investments from major venture capitalists and financial institutions. This further fuelled their expansion, with growth domestically in the US, but also internationally with them now having over 700 locations in 39 countries.

Fall – The dangers of overreaching

With all those features, it’s easy to see why WeWork initially did so well. Yet, those same features were major factors in its decline.

Overexpansion and High Costs

The aggressive expansion not only left it with a massive footprint, but also with massive bills. For WeWork to fulfil the needs of its target market, it needed long leases in prime locations. With increasing competition and changing market conditions, these became increasingly expensive, driving up the financial burden for the company.

Management and Governance issues

The initial focus for the business was to drive growth, not profit. This caused issues with wider management and investment, especially when the business tried to go public in 2019. This led to a restructure and the founder Adam Neumann stepping down.

Covid and a changing market

WeWork were massively impacted by Covid. Lockdowns forced people to work from home, so there was no need for costly office leases. This lead a lot of businesses to cancelled or not renew their leases. The move to remote working has also seen some businesses (particularly startups and freelancers) de-prioritise office space. This meant that WeWork were left with long leases on prime real estate, but no one to rent them.

These issues have combined to push WeWork into filing for bankruptcy. However, as Neumann’s attempt at repurchasing the company shows, there is more opportunity for brands like this than ever before…

Flexible workspace for a flexible market

The strengths that WeWork have may fit the market we have today better than it did pre-pandemic. Working now is more flexible, there are more startups than before and people need a good reason to come into the office.

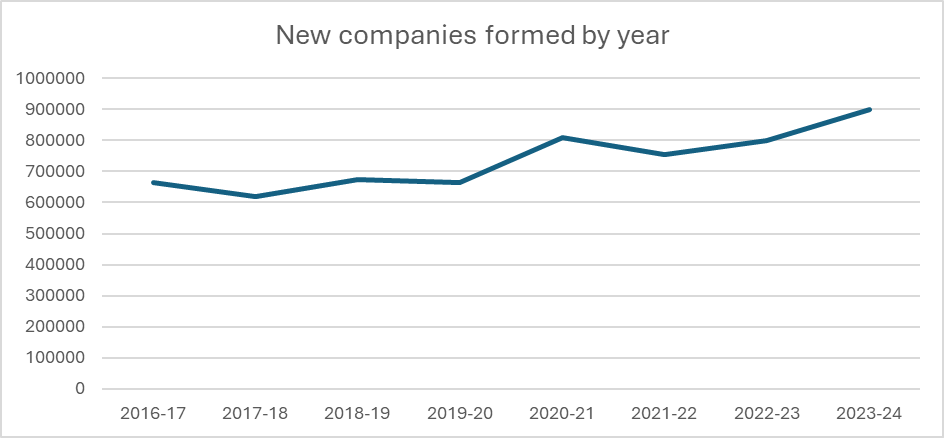

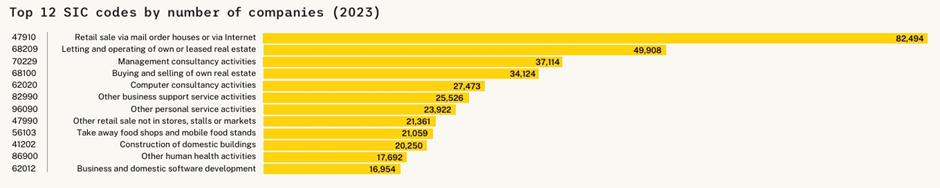

New Companies are on the rise

Companies formed in the UK reached a peak last year, with more new businesses starting in 2023 than pre or post pandemic. Most will start off working remotely, but its likely that they will want some kind of office space soon.

Changing Requirements

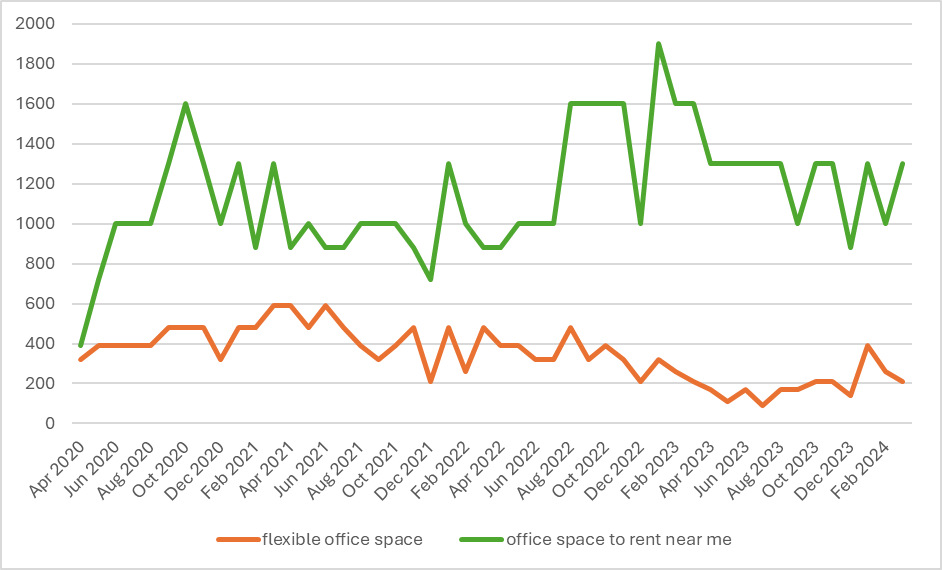

The previous WeWork model pushed the idea that great offices had to be in prime locations. Since the pandemic though, people have preferred to stay closer to home, although not necessarily “at home”. Since the pandemic, there has been a rise in searches for “office space to rent near me”. In contrast, broader searches like “flexible office space” continue to decline. Workers may want an office experience, but do not want to travel far to get it.

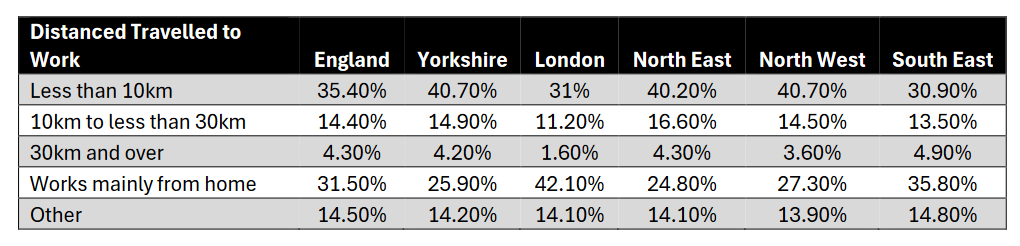

Cutting down on commuting

Commuting costs continue to be an issue with commuting costs for London passengers being nearly a quarter of their salaries. Driving isnt much better with the cost of owning a car costing around £300 more in 2023 than it did in 2022. The length of the commute also has an impact, with 28% of the English working population having to travel more than 10km to get to their place of work (ONS Data).

Those in London and the South East had the least amount commuting, with around 40% of workers working mainly at home. However, further north, commuters were more likely to travel into work, albeit to one close by. With people looking for more office space “near me,” it shows people might want to go to an office, but on their terms.

Peacocking in the workplace

Since the Pandemic proved that people could work at home and still be productive, it has been hard to get workers back into the office. This has led to an increasing number of businesses offering more in office perks, with updated décor, coffee machines, gyms and stocked kitchens.

These changes reflect what WeWork started out doing. They offered high quality, flexible office space that helped to foster a community feeling. This would work well again, but instead of focusing on prime real estate, focus on commuting costs and ease

What does the future look like?

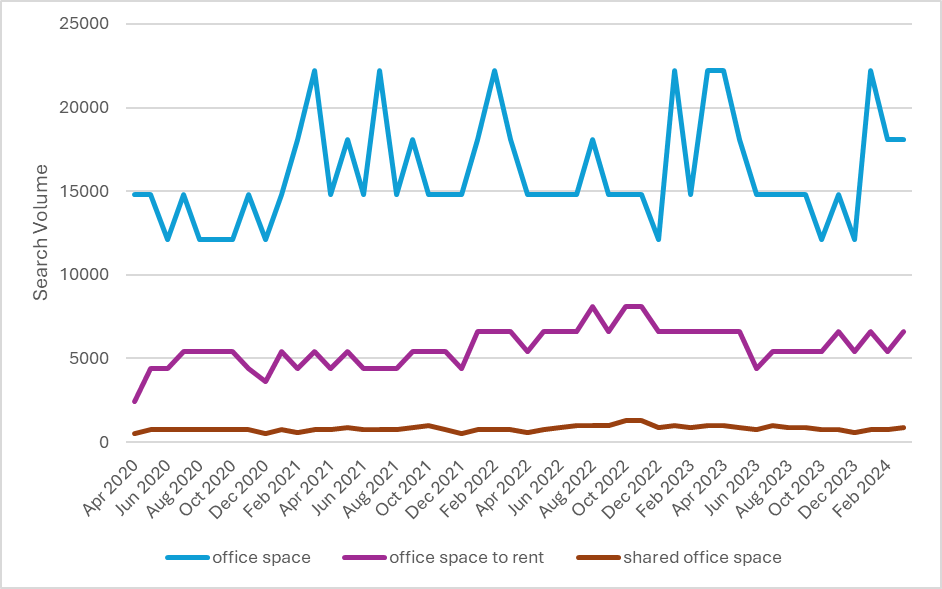

After a difficult period over Covid and a transition to “Hybrid working,” the office market is making a steady comeback. Search volumes for terms like “office space” have picked up and stabilised, whilst terms like “shared office space” and “office space to rent” have seen small, but steady levels of growth.

This is likely to only increase when we think about the types of businesses being created in 2023. Online Businesses and Consultancy services start off from home, but will need an office as they expand.

Due to the nature of their businesses, flexible office space, which provides a comfortable but professional setting would be a great way for them to grow. But there are going to be things that are important for Office providers to take into account.

Desk Types and Comfort

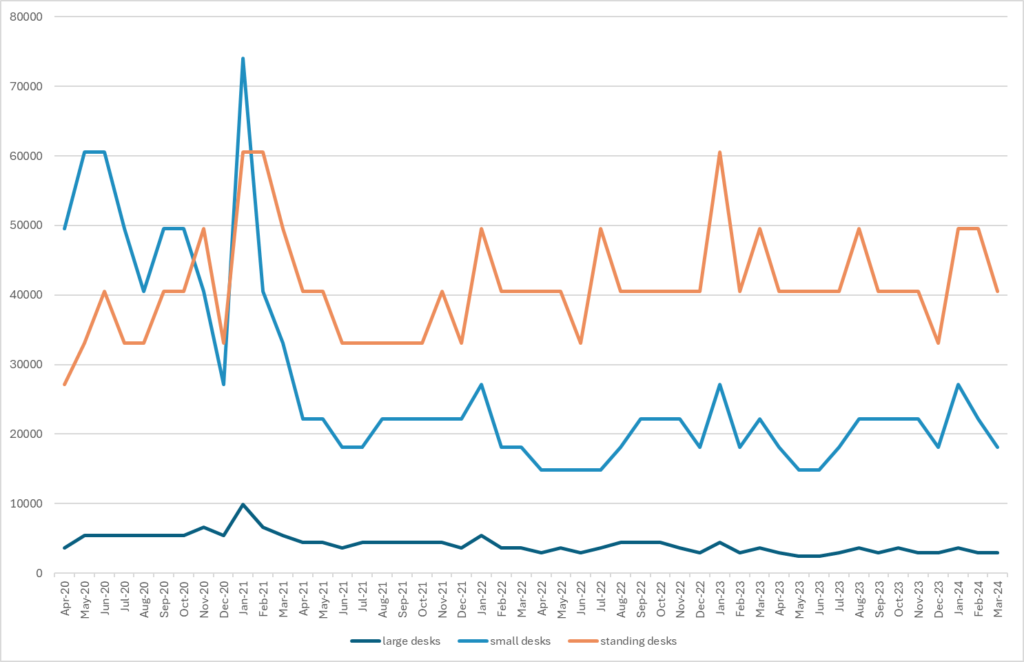

Standing desks are not going away. The chart below shows the difference between standing, small and large desk searches. During covid searches for “small” and “standing desks” saw a steady rise. Since then small desks have dropped off to pre-covid levels, but standing desks have held at their increased level.

People want to be healthier and see standing desks as an opportunity to do that. Having an office space that takes this into account will be far more attractive to the average office goer.

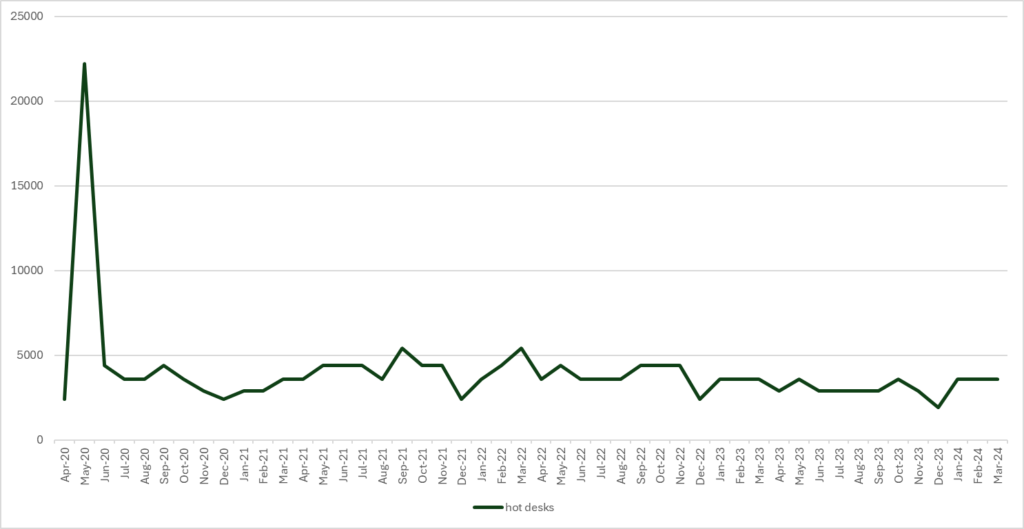

In contrast though, hot desking is on the way out. After covid there was a massive rise in searches for this whilst people got used to homeworking. Since then though, searches have been in a slight decline. It seems as though people are now used to working form home and don’t need hot desks.

If people are going to give up working from home, there needs to be a good reason to do it. Things like standing desks are going to draw people back, alongside things like coffee machines and spacious office space. Knight Frank talk about this in their The Future of Office Design report. In it they highlight that the focus should be on employee wellbeing, reimagining the space and making it more experiencial.

Value vs Cost

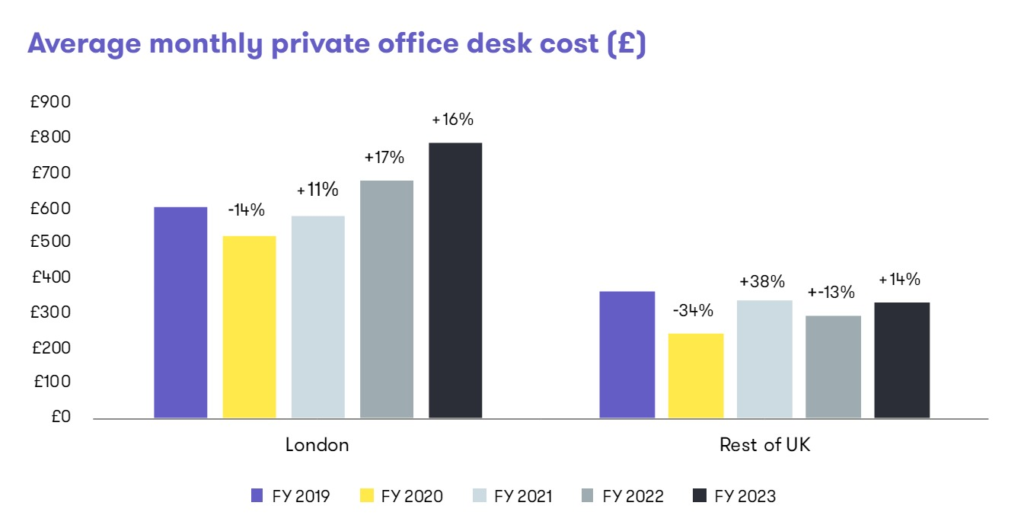

The UK is in recession so cost is having a bigger impact on businesses decision making. Generally, having people work from home is cheaper, so in an era of rising costs an office has to provide value.

However, a recent report from Workthere on the Flexible Office Market in 2023 showed that costs were rising, with London private office desk costs actually rising beyond where they were pre-covid. In contrast, those outside of London have risen, but no where near as much. With commutes being longer and potential WFH options being better, those with office space outside of the capital cannot raise prices like they once did.

Truely Hybrid Working

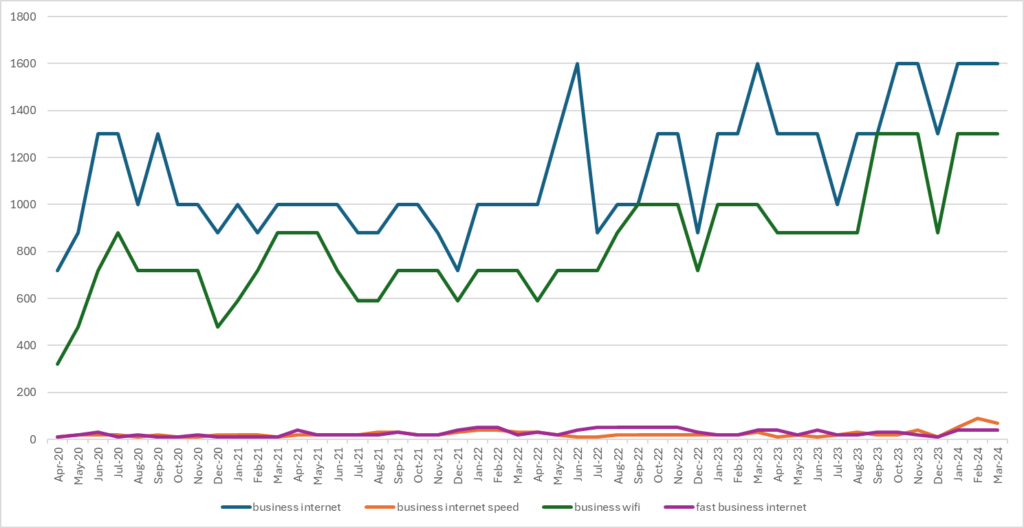

Hybrid working is now the norm for some jobs, with 36% of people working from home at least some of the time according to the ONS. With this in mind its important for those in the office to be able to communicate effectively with those working elsewhere. This means your internet connection is more important than ever.

The table above shows the rise in searches for “business internet” and “business wifi” with more searchers than ever looking for improved speeds and reliability. If offices can offer faster and more reliable WIFI than at home, then its another reason to head back into the office.

The Impact of “The Great British Summer”

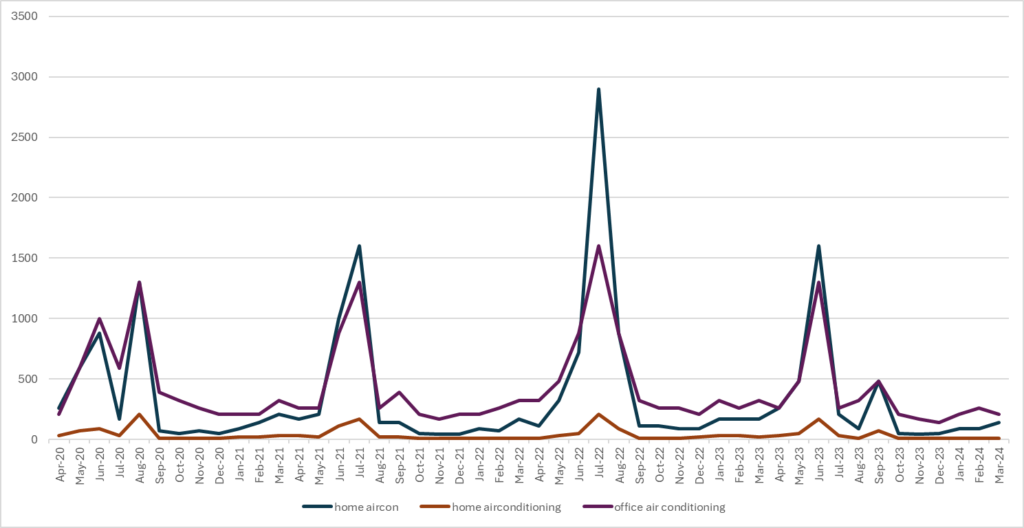

Over the past few summers we have seen temperatures in the UK pushing 30-40 degrees. Whilst this heat is fine on a beach in Spain, its stifiling when in the middle of a city. This is shown when we look at peaks in searches for “air conditioning”:

Offices are one of the few places in the UK to routinely be fitted out with air conditioning. The office could potentially position itself as a blessed relief in some of those hotter days.

Conclusions

Whilst WeWork have had their problems, the approach they initially took to office space still has its place. If office space providers and businesses are looking to encourage more people back to the office, they need to take into account what made WeWork so popular in the first place.

Brands need to provide a great place to work, thats reasonably priced, easy to get to and has good facilities. Without those features all working together, its hard to see why someone would come back to the office if they didn’t need to.